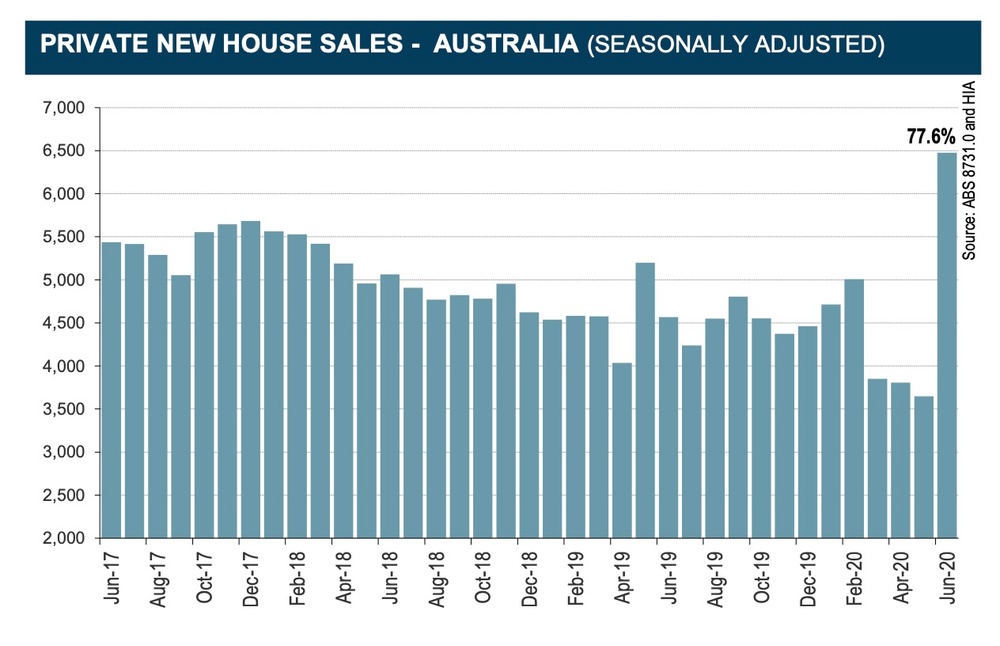

The COVID-19 pandemic has had a hugely significant impact on all industries. The building and construction industry has, in particular, been severely affected. In May, the Australia Bureau of Statistics recorded a sharp 11.6% drop in home loans, making it the worst month on record.

However, the introduction of the Federal Government’s HomeBuilder scheme resulted in a massive 77.6% spike in new home sales in June.

This is a positive turn for the building industry, as well as the wider Australian economy. Not only does it provide many builders and contractors with job security for the rest of 2020 and the first half of 2021, but the positive economic ramifications also extend to other industries, such as retail, hospitality, and manufacturing.

Western Australia has seen the most significant improvement, with sales doubling in June. This is likely thanks to the additional $20,000 Building Bonus grants offered by the State Government.

What is HomeBuilder?

The Government’s $688 million HomeBuilder scheme was announced in early June. The scheme provides eligible homeowners and first home buyers with a $25,000 grant in order to build a new home worth up to $750,000 or undertake significant renovations.

Despite initial confusion, the scheme has, so far, proven to be a success by providing the necessary stimulus for those in the construction sector to remain employed during the coronavirus pandemic.

Though the scheme is uncapped – meaning there is no limit to the number of people able to access the grant – there eligibility requirements that must be fulfilled in order to access the scheme, including:

- Applicants must be Australian citizens and be over 18 years of age

- Companies and trusts are illegible

- For renovations, between $150,000 and $750,000 must be spent and the home must be worth less than $1.5 million

- For new homes, the home must be worth less than $750,000, including the value of the land

Unlike the First Home Owner Grant, the HomeBuilder scheme is open to all owner-occupants, not just first time home buyers. It is not, however, available for investment properties or to owner-builders.

If applying for the HomeBuilder grant, contracts must be executed between 4 June and 31 December 2020, and work must begin within three months of the contract date.

The Future of the Building and Construction Industry

While the sharp rise in new home sales in June is a positive sign, only time will tell whether June was an outlier or part of a broader trend.

As HIA’s (Housing Association Limited) Chief Economist, Tim Reardon, stated, “The rebound in New Home Sales in June does not fully offset the dismal results of the preceding three months and we are cautious of over-interpreting data from a single month.”

“Additional sales data from July and August will be necessary before drawing accurate estimates on the impact of HomeBuilder on employment in the sector,” Reardon added.

Additionally, while sales have experienced a significant increase, the national cancellation rate on new home sales remains high, at 23%.