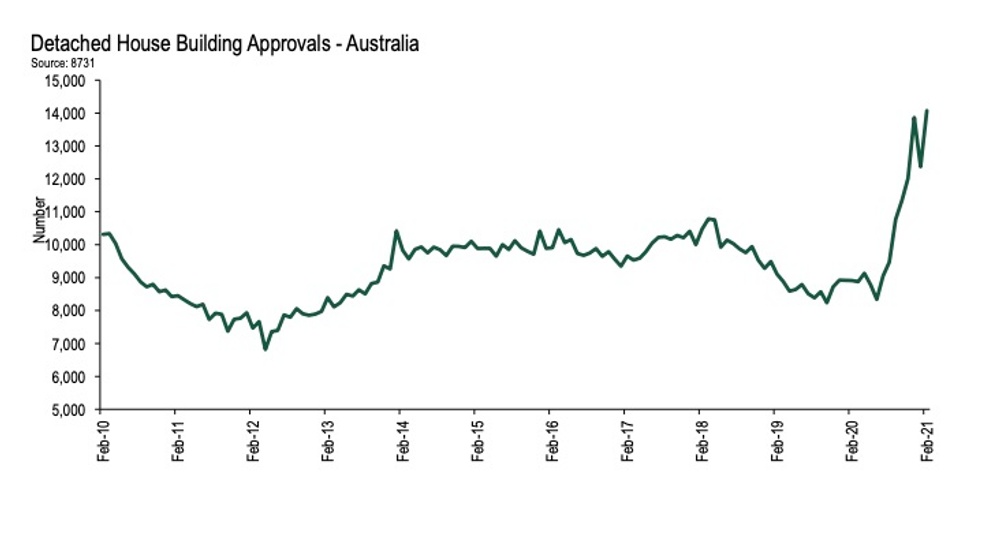

New data has revealed the continued success of the HomeBuilder grant scheme, with detached building approvals in February reaching their highest level on record. The Australian Bureau of Statistics released the numbers on 1st April, showing the ongoing high levels of approvals in the first months of 2021.

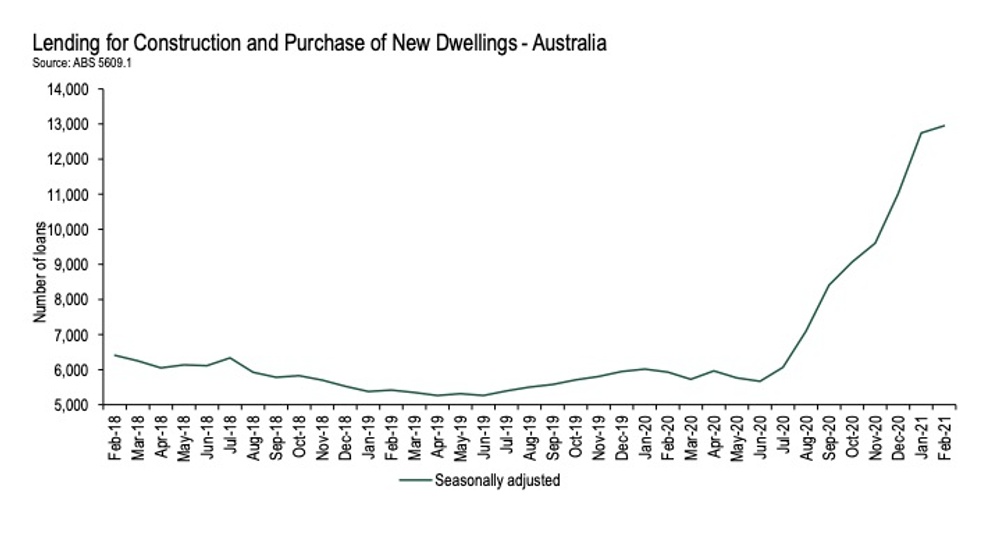

Approvals for detached houses in the three months to February 2021 were 50.7% higher than the same time last year. Tim Reardon, Chief Economist at Housing Industry Association (HIA), noted that “the number of loans for the construction of a new dwelling [marked] six consecutive months of record highs.”

New Build Loans Surge Across The Country

The unprecedented levels of growth and loan approvals have been felt across Australia, with every state and territory experiencing significant increases in the numbers of loans granted to owner-occupiers.

From December to February, the number of loans for construction of a new dwelling increased in Western Australia by 255%, in the Northern Territory by 200%, in Queensland by 191% and in Tasmania by 176%. The more densely populated states of Victoria and New South Wales also experienced a rise in owner-occupier loan approvals, with 108% and 86% increases respectively.

HomeBuilder Grants Contribute To High Demand

HomeBuilder, which was introduced to support the construction industry during the COVID-19 pandemic, has driven the strong demand for new homes. Since the introduction of the scheme in June 2020, data from the ABS and from HIA’s Housing Scorecard has shown sharp increases in the number of people wanting to build their own home. The impact of this is expected to be seen in the March data when that is released.

“New home sales spiked in December as home buyers rushed to meet the deadline of the first phase of HomeBuilder,” Mr Reardon said. “New Home Sales in March are expected to be comparable to those in December 2020 as home buyers rush to meet the deadline for the second – and final – phase of HomeBuilder.”

First home buyers are taking advantage of the grants, with 40% of loans over the last seven months going to people buying a home for the first time.

Renovation Loans Also Reach High Levels

People wishing to renovate their existing home have also benefited in the past three months. Lending for renovation reached its highest level since 2009 in February as more Australians looked to improve their living spaces following the lockdowns of last year.

“The value of loans for alterations and additions in the three months to February 2021 is 47.6% higher than the same time last year,” Mr Reardon said. “Households have changed their spending habits in response to the COVID-19 interruptions. Many have diverted funds that would have typically been spent on travel and entertainment into buying a new home or improving their existing one.”

Apartment Projects Receive Lower Approval Rates

While detached builds have seen record highs in recent times, the multi-unit sector has been devastated by the COVID-19 crisis. Many apartment buildings are unable to receive funding due to slow demand as people move out of cities and into regional areas, and less short-term residents enter the country.

“The absence of overseas migrants and students will continue to impede multi-commencements,” Mr Reardon predicted. “Multi-unit approvals remain lower by 21.6 per cent compared to the same quarter last year. Multi-unit projects that are gaining approval at this time are likely to have commenced the planning and building approval process before the pandemic.”

It is expected that the apartment market will be unable to return to normal levels of growth until overseas migration returns in numbers similar to pre-pandemic times.