Australia’s famously strong property market has bounced back from predictions of decreases in home values, with newly released data showing a 5.3% rise in median house prices.

The average cost of a house in Australia is now $936,073, higher than ever before and surpassing the record set in March of 2020. The data from the Domain House Price report demonstrates that the rise in prices was spread across unit prices as well, with a 4.4% increase in the median price of a unit, to $569,677.

The rise in real estate prices has surprised many in the industry, as historically home values fall during times of economic downturn. However, experts are now predicting further increases, with Westpac economists forecasting a 15% rise in prices over the next two years.

Pandemic Support Affecting Real Estate Price Increase

There are a lot of factors at play in the unexpected rise in real estate prices. Record low interest rates have made it easier for home buyers to access loans, allowing first time purchasers to enter the property market. There has also been an increase in government grants and incentives, such as the HomeBuilder grant, which was introduced to support the construction industry. This ease of access increases competition, which in turn pushes property prices higher.

Additionally, income support from the government such as JobKeeper and pauses on loan repayments have kept people in the property market who may have defaulted on their mortgage otherwise. In previous recessions, massive job losses have resulted in people being forced to sell their homes, leading to an influx of property on the market and lower prices. But with government incentives keeping people in their homes, more people are competing for fewer homes.

Finally, the pandemic caused many people to stay at home and spend less. This enforced saving has allowed some people to raise the extra capital they needed to buy their first home or upgrade their current one.

State by State Housing Prices

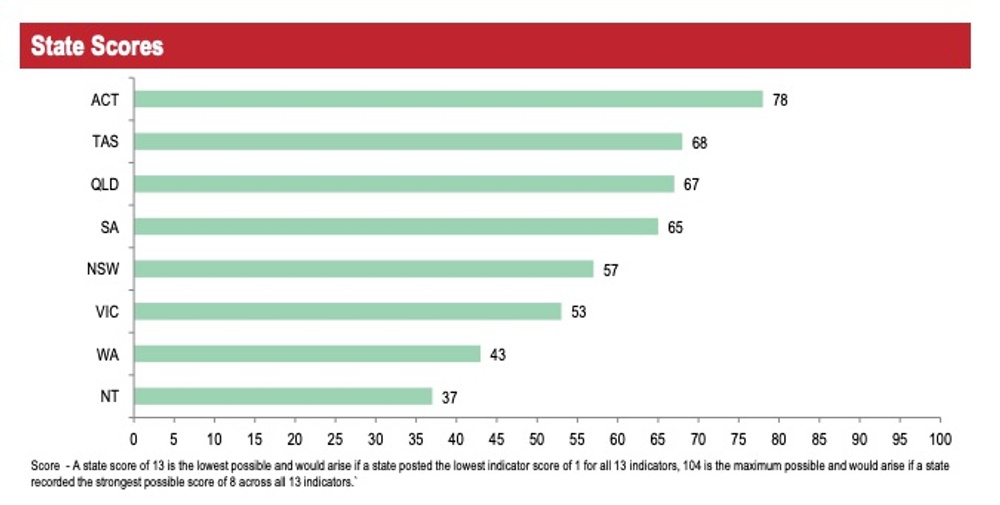

While all of Australia is experiencing an increase in real estate prices, the COVID-19 pandemic has dramatically altered trends in housing demand. HIA's Housing Scorecard analyses the states and territories based on their performance across key residential building indicators, including renovations, housing finance, and rates of migration. Surprisingly, the Australian Capital Territory has topped the scorecard in the most recent results, benefiting from population growth and a stable labour market during a time when other parts of the country were experiencing huge job losses.

Previously strong states, such as Victoria and New South Wales, have dropped to sixth and fifth placed respectively. States with smaller populations, such as Tasmania and South Australia, remained in strong positions due to ongoing state government support for home building and positive interstate migration.

The proliferation of working from home saw a rise in the demand for regional properties, with home values increasing 6.9% in 2020. In capital cities, by comparison, there was a 2% rise.

Taking Advantage of Rising Real Estate Values

Property values are expected to continue strongly in 2021, and now is the perfect time to take advantage of the strong real estate market. Building a home now allows you to take advantage of government grants and incentives such as HomeBuilder. Your completed home will be worth a lot more money in the future, making it ideal to sell and make a profit.

If you’re thinking about starting a new home build, why not let Homeshelf take some of the stress out of the process? We can help you find the perfect builder for your new home.